THE DANGEROUS MORALITY OF MANAGING EARNINGS*

The Majority of Managers Surveyed Say It’s Not Wrong to Manage Earnings

Occasionally, the morals and ethics executives use to manage their businesses are examined and discussed. Unfortunately, the morals that guide the timing of nonoperating events and choices of accounting policies have largely been ignored. The ethical framework used by managers in reporting short-term earnings probably has received less attention than its operating counterpart because accountants prepare financial disclosures consistent with laws and generally accepted accounting principles (GAAP). Those disclosures are reviewed by objective auditors. Managers determine the short-term reported earnings of their companies by:

• Managing, providing leadership, and directing the use of resources in operations.

• Selecting the timing of some nonoperating events, such as the sale of excess assets or the placement of gains or losses into a particular reporting period.

• Choosing the accounting methods that are used to measure short-term earnings.

Casual observers of the financial reporting process may assume that time, laws, regulation, and professional standards have restricted accounting practices to those that are moral, ethical, fair, and precise. But most managers and their accountants know otherwise—that managing short-term earnings can be part of a manager’s job. To understand the morals of short-term earnings management, we surveyed general managers and finance, control, and audit managers. The results are frightening. We found striking disagreements among managers in all groups. Furthermore, the liberal definitions revealed in many responses of what is moral or ethical should raise profound questions about the quality of financial information that is used for decision-making purposes by parties both inside and outside a company. It seems many managers are convinced that if a practice is not explicitly prohibited or is only a slight deviation from rules, it is an ethical practice regardless of who might be affected either by the practice or the information that flows from it. This means that anyone who uses information on short-term earnings is vulnerable to misinterpretation, manipulation, or deliberate deception

The Morals of Managing Earnings

To find a “revealed” consensus concerning the morality of engaging in earnings-management activities, we prepared a questionnaire describing 13 earnings-management situations we had observed either directly or indirectly. The actions described in the incidents were all legal (although some were in violation of GAAP), but each could be construed as involving short-term earnings management.

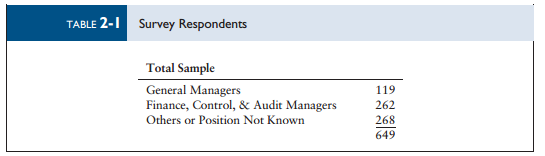

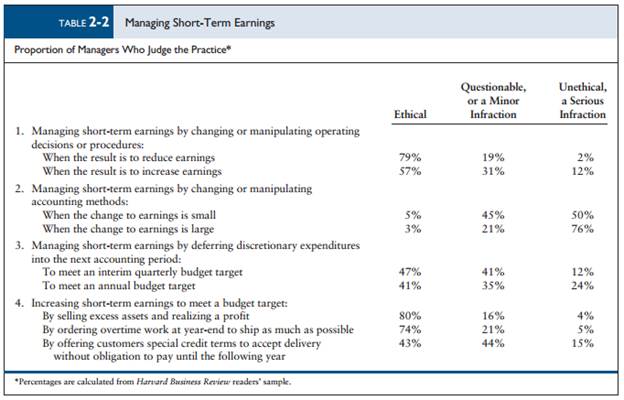

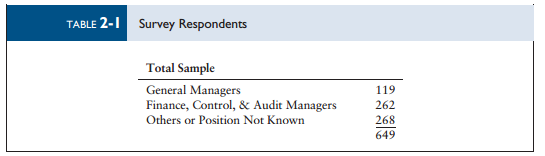

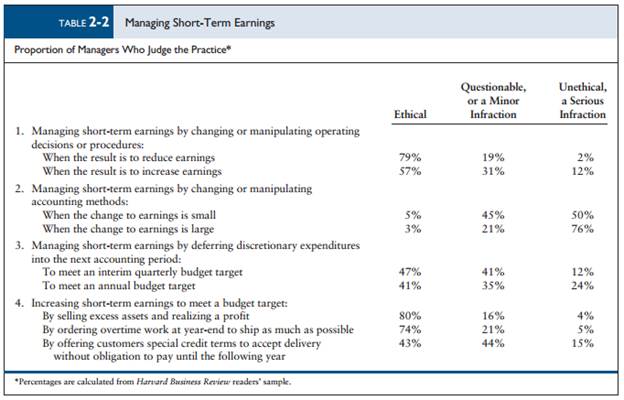

A total of 649 managers completed our questionnaire. Table 2-1 classifies respondents by job function, and Table 2-2 summarizes the views on the acceptability of various earningsmanagement practices

A major finding of the survey was a striking lack of agreement. None of the respondent groups viewed any of the 13 practices unanimously as an ethical or unethical practice. The dispersion of judgments about many of the incidents was great. For example, here is one hypothetical earnings-management practice described in the questionnaire:

In September, a general manager realized that his division would need a strong performance in the last quarter of the year in order to reach its budget targets. He decided to implement a sales program offering liberal payment terms to pull some sales that would normally occur next year into the current year. Customers accepting delivery in the fourth quarter would not have to pay the invoice for 120 days.

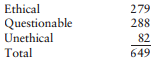

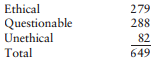

The survey respondents’ judgments of the acceptability of this practice were distributed as follows:

Perhaps you are not surprised by these data. The ethical basis of an early shipment/ liberal payment program may not be something you have considered, but, with the prevalence of such diverse views, how can any user of a short-term earnings report know the quality of the information? Although the judgments about all earnings-management practices varied considerably, there are some other generalizations that can be made from the findings summarized in Table 2-2

• On average, the respondents viewed management of short-term earnings by accounting methods as significantly less acceptable than accomplishing the same ends by changing or manipulating operating decisions or procedures.

• The direction of the effect on earnings matters. Increasing earnings is judged less acceptable than reducing earnings.

• Materiality matters. Short-term earnings management is judged less acceptable if the earnings effect is large rather than small.

• The time period of the effect may affect ethical judgments. Managing short-term earnings at the end of an interim quarterly reporting period is viewed as somewhat more acceptable than engaging in the same activity at the end of an annual reporting period.

• The method of managing earnings has an effect. Increasing profits by offering extended credit terms is seen as less acceptable than accomplishing the same end by selling excess assets or using overtime to increase shipments.

Managers Interviewed

Were the survey results simply hypothetical, or did managers recognize they can manage earnings and choose to do so? To find the answers, we talked to a large number of the respondents. What they told us was rarely reassuring.

On accounting manipulations, a profit center controller reported:

A divisional general manager spoke to us about squeezing reserves to generate additional reported profit:

If we get a call asking for additional profit, and that’s not inconceivable, I would look at our reserves. Our reserves tend to be realistic, but we may have a product claim that could range from $50,000 to $500,000. Who knows what the right amount for something like that is? We would review our reserves, and if we felt some were on the high side, we would not be uncomfortable reducing them.

We also heard about operating manipulations. One corporate group controller noted:

[To boost sales] we have paid overtime and shipped on Saturday, the last day of the fiscal quarter. If we totally left responsibility for the shipping function to the divisions, it could even slip over to 12:30 A.M. Sunday. There are people who would do that and not know it’s wrong.

Managers often recognize that such actions “move” earnings from one period to another. For example, a division controller told us:

Last year we called our customers and asked if they would take early delivery. We generated an extra $300,000 in sales at the last minute. We were scratching for everything. We made our plans, but we cleaned out our backlog and started in the hole this year. We missed our first quarter sales plan. We will catch up by the end of the second quarter.

And a group vice president said:

I recently was involved in a situation where the manager wanted to delay the production costs for the advertising that would appear in the fall [so that he could meet his quarterly budget].

Thus, in practice, it appears that a large majority of managers use at least some methods to manage short-term earnings. Though legal, these methods do not seem to be consistent with a strict ethical framework. While the managers’ actions have the desired effect on reported earnings, the managers know there are no real positive economic benefits, and the actions might actually be quite costly in the long run. These actions are at best questionable because they involve deceptions that are not disclosed. Most managers who manage earnings, however, do not believe they are doing anything wrong.

We see two major problems. The most important is the generally high tolerance for operating manipulations. The other is the dispersion in managers’ views about which practices are moral and ethical.

The Dangerous Allure

The essence of a moral or an ethical approach to management is achieving a balance between individual interests and obligations to those who have a stake in what happens in the corporation (or what happens to a division or group within the corporation). These stakeholders include not only people who work in the firm, but customers, suppliers, creditors, shareholders, and investors as well.

Managers who take unproductive actions to boost short-term earnings may be acting totally within the laws and rules. Also, they may be acting in the best interest of the corporation. But if they fail to consider the adverse effects of their actions on other stakeholders, we may conclude that they are acting unethically.

The managers we interviewed explained that they rated accounting manipulations harshly because in such cases the “truth” has somehow been denied or misstated. The recipients of the earnings reports do not know what earnings would have been if no manipulation had taken place. Even if the accounting methods used are consistent with GAAP, they reason, the actions are not ethical because the interests of major stakeholder groups—including the recipients of the earnings reports—have been ignored.

The managers judge the operating manipulations more favorably because the earnings numbers are indicative of what actually took place. The operating manipulations have changed reality, and “truth” is fairly reported.

We see flaws in that reasoning. One is that the truth has not necessarily been disclosed completely. When sales and profits are borrowed from the future, for example, it is a rare company that discloses the borrowed nature of some of the profits reported. A second flaw in the reasoning about the acceptability of operating manipulations is that it ignores a few or all of the effects of some types of operating manipulations on the full range of stakeholders. Many managers consider operating manipulations as a kind of “victimless crime.” But victims do exist. Consider, for example, the relatively common operating manipulation of early shipments. As one manager told us:

Would I ship extra product if I was faced with a sales shortfall? You have to be careful there; you’re playing with fire. I would let whatever happened fall to the bottom line. I’ve been in companies that did whatever they could to make the sales number, such as shipping lower quality product. That’s way too short term. You have to draw the line there. You must maintain the level of quality and customer service. You’ll end up paying for bad shipments eventually. You’ll have returns, repairs, adjustments, ill will that will cause you to lose the account.… [In addition] it’s tough to go to your employees one day and say ship everything you can and then turn around the next day and say that the quality standards must be maintained.

Another reported:

We’ve had to go to [one of our biggest customers] and say we need an order. That kills us in the negotiations. Our last sale was at a price just over our cost of materials.

These comments point out that customers—and sometimes even the corporation—may be victims

Without a full analysis of the costs of operating manipulations, the dangers of such manipulations to the corporation are easily underestimated. Mistakes will be made because the quality of information is misjudged. The short term will be emphasized at the expense of the long term. If managers consistently manage short-term earnings, the messages sent to other employees create a corporate culture that lacks mutual trust, integrity, and loyalty.

A Lack of Moral Agreement

We also are troubled by the managers’ inability to agree on the types of earnings-management activities that are acceptable. This lack of agreement exists even within corporations.

What this suggests is that many managers are doing their analyses in different ways. The danger is obfuscation of the reality behind the financial reports. Because managers are using different standards, individuals who try to use the information reported may be unable to assess accurately the quality of that information

If differences in opinions exist, it is likely that financial reporting practices will sink to their lowest and most manipulative level. As a result, managers with strict definitions of what is moral and ethical will find it difficult to compete with managers who are not playing by the same rules. Ethical managers either will loosen their moral standards or fail to be promoted into positions of greater power.

Actions for Concerned Managers

We believe most corporations would benefit if they established clearer accounting and operating standards for all employees to follow. The standard-setting process should involve managers in discussions of the practices related to short-term earnings measurements. Until these standards are in place, different managers will use widely varying criteria in assessing the acceptability of various earnings-management practices. These variations will have an adverse effect on the quality of the firm’s financial information. Companies can use a questionnaire similar to the one in our study to encourage discussion and to communicate corporate standards and the reason for them. Standards also enable internal and external auditors and management to judge whether the desired quality of earnings is being maintained. In most companies, auditors can depend on good standards to identify and judge the acceptability of the operating manipulations. Ultimately, the line management chain-of-command, not auditors or financial staff, bears the primary responsibility for controlling operating manipulations. Often managers must rely on their prior experience and good judgment to distinguish between a decision that will have positive long-term benefits and one that has a positive short-term effect but a deleterious long-term effect. Finally, it is important to manage the corporate culture. A culture that promotes openness and cooperative problem solving among managers is likely to result in less short-term earnings management than one that is more competitive and where annual, and even quarterly, performance shortfalls are punished. A corporate culture that is more concerned with managing for excellence rather than for reporting short-term profits will be less likely to support the widespread use of immoral earnings-management practices.

Required

a. Time, laws, regulation, and professional standards have restricted accounting practices to those that are moral, ethical, fair, and precise. Comment.

b. Most managers surveyed had a conservative, strict interpretation of what is moral or ethical in financial reporting. Comment.

c. The managers surveyed exhibited a surprising agreement as to what constitutes an ethical or unethical practice. Comment.

d. List the five generalizations from the findings in this study relating to managing earnings.

e. Comment on management’s ability to manage earnings in the long run by influencing financial accounting.

"Looking for a Similar Assignment? Get Expert Help at an Amazing Discount!"

Assignment-in….pdf

Assignment-in….pdf F5F1BA03-1CE6….jpeg

F5F1BA03-1CE6….jpeg 91314-GM-Week….docx

91314-GM-Week….docx We are a leading academic writing company, which has been providing exclusive writing services for years.

We are a leading academic writing company, which has been providing exclusive writing services for years.